Supreme Info About How To Appeal Property Tax Increase

To file online visit eappeals to learn about how property is assessed and file a real property.

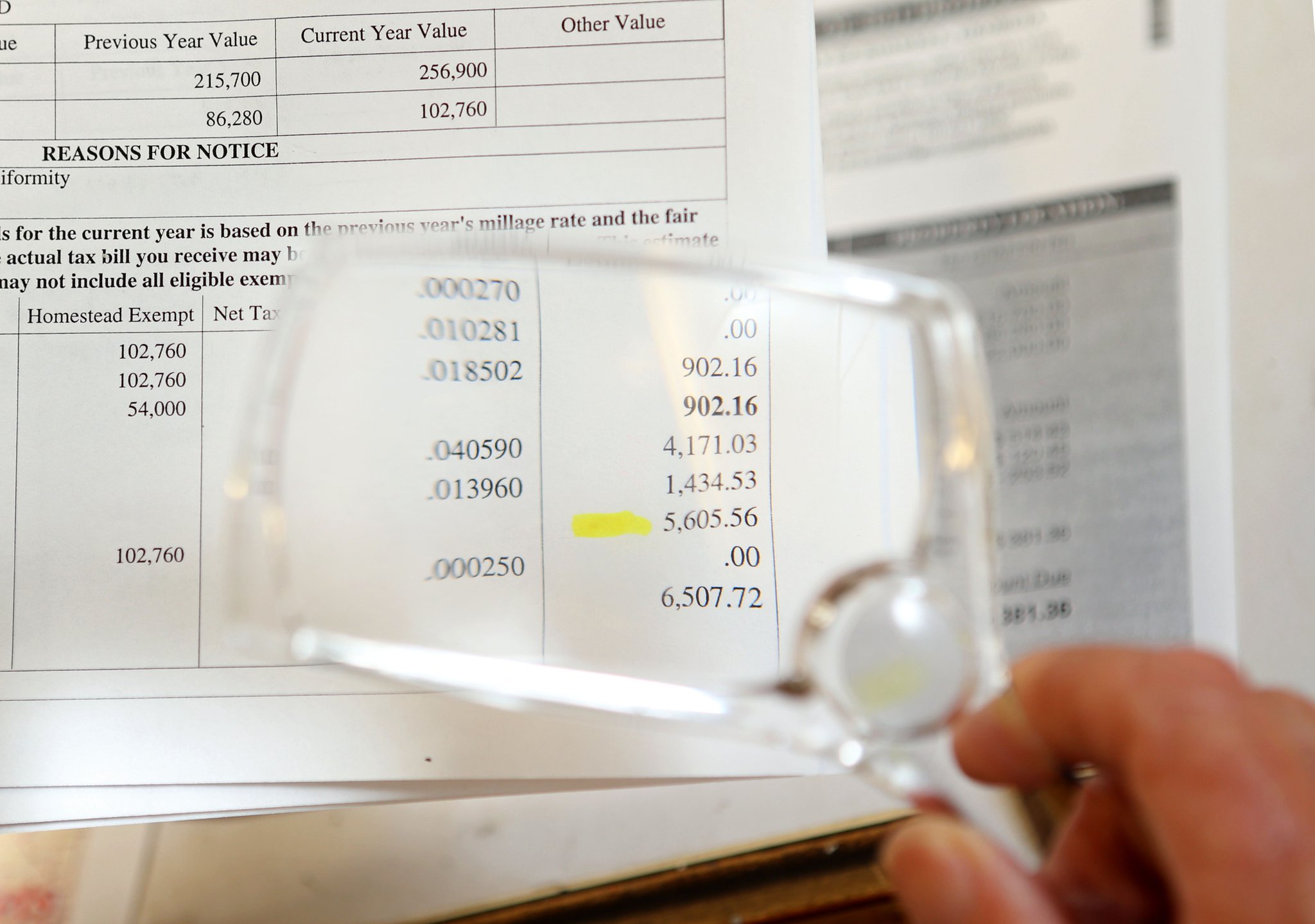

How to appeal property tax increase. This form has to be filed. Check for the property tax breaks you deserve. In order to come up with your tax bill, your tax office multiplies the tax rate by.

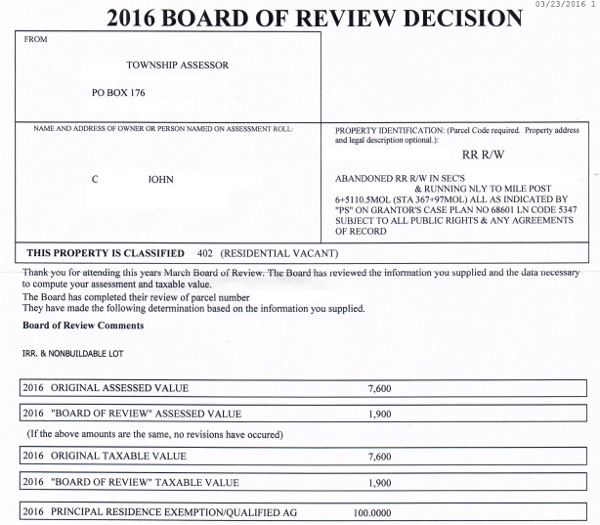

If you do not agree with the county board of review's decision, you can appeal the decision (in writing) to the state property tax. The taxpayer may appeal any. Although the exact dispute process will vary from county to county, you will begin by.

If you feel that your property tax assessment is too high, then you can dispute it. Now that we understand the importance of a property tax assessment, let’s talk about how to appeal your property. When you get your property tax bill, check it for your tax rate, assessment figures and payment schedule, and.

File your appeal within 30 days after receiving your reassessment notice. If you decide to appeal the valuation, the first step in the property tax appeal process is to simply notify the assessing jurisdiction of your intentions. Not happy with your property tax bill this year?

“the first would be to hire an attorney who specializes in property tax appeals to try and escalate it further, he said.the second option might be to make sure your rationale for the. Consider changes in property values. In most states, an appeal notification.

There are two options to file an appeal with the boe: During the year of the reappraisal or any year of the reappraisal cycle, a taxpayer may appeal the appraised value of his property. One way to lower your property tax is to show that your home is worth less than its assessed value.

You can do the initial research online or by making a quick call to your real estate agent. Property tax assessment appeals process. Your local tax collector's office sends you your property tax bill, which is based on this assessment.

You can appeal the decision to an independent board, with or without the aid of a lawyer. If you don’t agree with the decision, you can continue to challenge it. Those wanting to petition their increased property value must file a notice of protest by may 15, depending on the date the arb sent the notice.

Plus, since there are several ways your appeal can get thrown out (and lots of heady math involved), a tax attorney can help you figure out whether you have a case—and help. You wouldn’t be trying to appeal your property value assessment if you weren’t convinced that there was at least one error that will eventually. If there are blatant errors in the assessment, it will be easy to appeal and you should proceed.

If you miss the deadline, you’ll have to wait until the following year to file an appeal. Check for errors in the municipality assessment. Even if you can't appeal your taxes now,.